Securing the free and fair flow of data

FHFA Velocity TechSprint

In July 2023, FHFA held its first-ever TechSprint. Named “Velocity,” the TechSprint brought together experts and practitioners from the technology and the mortgage finance sectors to solve a common challenge: How might data digitization drive transparency and increase access, fairness, affordability, and sustainability in mortgage lending?

FHFA’s Velocity TechSprint was held at FHFA’s Constitution Center headquarters in Washington, DC and ran from July 10 to July 13, 2023.

Problem Statements

Umbrella Statement

How might data digitization drive transparency and increase access, fairness, affordability, and sustainability in mortgage lending? Adoption of data digitization can unlock the mortgage ecosystem. This can be especially beneficial in the current economic environment where profit margins are compressed while regulatory requirements remain a top priority. The adoption of data digitization can serve as a competitive advantage for participants in the mortgage ecosystem as market conditions evolve.

How might borrowers, lenders, loan aggregators, and infrastructure providers be better equipped and motivated to leverage data-driven digital approaches in front end-mortgage processes?

- To improve borrower experience and transparency?

- To drive simplification?

- To improve cycle times?

- To improve equitable access, fairness, affordability, and sustainability?

- To better manage risk?

- What are the tradeoffs or unanticipated consequences (if any) across these sets of goals?

How might regulators consider current barriers to greater adoption of financial technology in mortgage processes, responsible alternatives, system impacts, and options for streamlining requirements?

Any technologies adopted should reduce cycle times, lower the cost to originate, allow savings to be passed to the consumer, open opportunities to underserved borrowers, or increase ease and transparency to borrowers. Additionally, these same technologies should seek to mitigate risks, such as data security and privacy risks that may arise, while also including viable strategies to engage borrowers, drive adoption, and build trust in a more digital mortgage process.

Focused Statements

- Direct-to-Source Data: How might we leverage and enhance the process of data verification during the loan origination process to reduce loan origination costs, improve cycle times, and streamline quality control processes, while maintaining safe and sound practices?

- Data Quality: How might technology support the verification, standardization, and validation of data from varied traditional sources during the loan origination process in order to reduce loan origination costs and improve cycle time, while maintaining safe and sound practices?

- Adoption and Implementation: How can we increase the adoption of digitized mortgage processes in loan origination so that both lenders and borrowers can achieve optimized mortgage cycle times and reduced loan origination costs and risks?

- Alternative Data: How might we better identify sources of alternative data that could be used in mortgage lending processes and facilitate the availability, accessibility, collection, certification, and usage of that data for loan origination and underwriting purposes, so that mortgage access can be expanded, costs can be reduced, and cycle times can be improved, while maintaining safe and sound practices?

- Digital Experience and Trust: How might we enhance the use of technology and data in the digital mortgage experience, so that borrowers have greater access to, are better prepared for, and have greater confidence in the use of technology in the mortgage process and so that lenders and other industry participants are trained in a more digitized mortgage process?

Observer Track Panel Discussions

During the four-day TechSprint, the Observer Track convened panelists from across the finance and technology sectors to debate and explore the tough issues underlying the TechSprint’s activities. Links to the panels are provided below, and videos of the panels can be viewed on FHFA’s YouTube page.

An overview of the agenda is shown below. View / download the full agenda.

| Observer Track Sessions | |

|---|---|

| July 10 Virtual | Opening Remarks by Sandra L. Thompson, FHFA Director Keynote Address by John Hope Bryant, Founder, Chairman, and CEO, Operation HOPE Panel: The Growing Role of Data Science in Housing Finance Participants: Michael Akinwumi, Chief Tech Officer, NFNH; Pete Carroll, Executive Public Policy and Industry Relations, CoreLogic; Melissa Koide, CEO, FinRegLab; Joanna Smith Ramani, Co-Executive Director, Aspen Institute Financial Security Program; David Ehrich - Moderator, Co-Founder and Executive Director, Alliance for Innnovative Regulation (AIR) Panel: Fintech Founders’ Perspectives: Using Experience to Drive Change Participants: Wemimo Abbey, Co-Founder and Co-CEO, Esusu Financial, Inc.; Erin Allard, General Manager, Petal/Prism Data; Misha Esipov, Co-Founder & CEO, Nova Credit; Amias Gerety - Moderator, Partner, QED Investors |

| July 11 Virtual | Panel: Using Data as a Competitive Advantage: Lenders in the Age of Fintech Participants: David Battany, Executive VP, Guild Mortgage; Jennifer Kouchis, Chief Mortgage Banking Officer, VyStar Credit Union; Steve Majerus, CEO, Synergy One Lending, Inc.; Erik Schmitt, CFA, CPA, Managing Director, Head of Marketing Transformation, Chase Consumer and Community Banking; Faith Schwartz - Moderator, Founder and CEO, Housing Finance Strategies |

| July 12 Virtual | Panel: Surviving the MortgageTech Winter: Where Do We Go from Here? Participants: Nate Levin, Managing Director, Parker89; Frank Rotman, Founding Partner, QED Investors; Jeremy Soloman, Partner, NYCA; Simon Taylor, Head of Strategy, Sardine; Peter Renton - Moderator, Co-Founder and Chairman, Fintech Nexus Panel: Building the Pipes: The Partnership Between Fintechs and Data Aggregators Participants: Shmulik Fishman, Co-Founder & CEO, Argyle; Meredith Fuchs, General Counsel, Plaid; Kurt Lin, Co-Founder & CEO, Pinwheel; Lynn Sheck, Senior Vice President, Open Banking, Mastercard; Don Cardinal - Moderator, Managing Director, Financial Data Exchange |

| July 13 Virtual | Opening Remarks by Jason Cave, Deputy Director, Division of Conservatorship Oversight and Readiness (DCOR), FHFA Fireside Chat: Keeping Tech Fair for the Consumer Participants: Delicia Hand, Director, Financial Fairness Advocacy, Consumer Reports; Lisa Rice, President & CEO, National Fair Housing Alliance (NFHA); Jo Ann Barefoot - Moderator, Co-Founder, Alliance for Innovative Regulation (AIR) Participant Demos Panel: Data and Access Opportunities andChallenges: The Regulators’ Perspectives Participants: Ann Epstein, Assistant Director Office of Competition and Innovation, CFPB; Grovetta Gardineer, Senior Deputy Comptroller of Bank Supervision Policy, OCC; Sunayna Tuteja, Chief Innovation Officer, Federal Reserve System; Anne Marie Pippin - Moderator, Associate Director, Financial Technology Office, FHFA Awards and Closing |

Exploring Ideas and Solutions

Over the four days of the TechSprint, 80 participants from 60 companies – together with FHFA and industry experts – worked together to explore ideas and solutions to the Velocity problem statements.

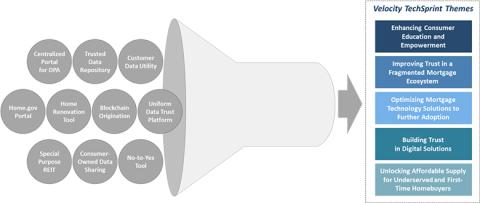

The TechSprint culminated on “Demo Day,” when each team delivered a five-minute presentation before an independent judging panel. The presentations explored themes, such as:

- Enhancing consumer education and empowerment;

- Improving trust in a fragmented mortgage ecosystem;

- Optimizing mortgage technology solutions to further adoption;

- Building trust in digital solutions; and

- Unlocking affordable supply for underserved and first-time homebuyers.

For additional information, please see FHFA’s summary of the key themes from the Velocity TechSprint. FHFA’s thematic summary offer readers an understanding of the insights that were uncovered through the TechSprint, including stakeholder feedback on key avenues through which technology and data can be harnessed to enhance mortgage origination processes.

Recognition

Recognitions in four categories were presented to three teams:

- Team FINnovation: the Jump recognition for biggest potential impact, and Crowd Favorite recognition for their “industry cooperative utility that houses consumer-owned data and automates all upfront verifications.”

- Team Home4All: the Eureka recognition for most creative, for their “home.gov” chatbot-enabled financial education service that centralizes information about mortgage products and requirements to help potential borrowers build credit and connect with lenders.

- Team U-Turn 180: the Fast recognition for quickest to market, for their “N to Y” tool that helps potential borrowers whose mortgage applications were declined to build their credit and “get to yes.”

Find Out More

A blog post from FHFA Deputy Director Jason Cave Recapping FHFA’s Inaugural TechSprint provides more detail on the four days of the Velocity TechSprint.

Videos from the Velocity TechSprint, including Opening Day, Demo Day, and the Observer Track panel sessions are available on FHFA’s YouTube page.

For more information on FHFA’s Office of Financial Technology, please visit FHFA’s Financial Technology page.

For further information, please contact the FHFA Office of Financial Technology at fintech@fhfa.gov.

Page Last Updated: December 22, 2023