Overview

On November 25, 2024, FHFA issued Non-Objections to the Duty to Serve 2025-2027 Underserved Markets Plans submitted by Fannie Mae and Freddie Mac. The Plans detail the Enterprises’ activities to serve the manufactured housing, rural housing, and affordable housing preservation markets over a three-year period. On December 11, 2025, FHFA issued Non-Objections to their modified Plans. Read more

If you have any questions or concerns, please send an email to DutyToServeStakeholders@FHFA.gov.

What's New

Resources

Data and Tools

Access datasets and interactive maps on the DTS Eligibility Data Page or DTS-qualifying rural areas, Indian areas, high opportunity areas, and areas of concentrated poverty. Also, access information and dashboards on the DTS Performance Data Page.

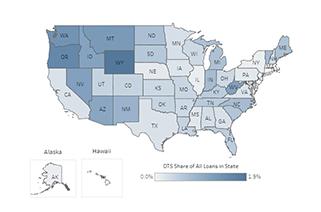

2024 DTS Single-Family Dashboard

The Single-Family Dashboard is an interactive map that looks at the share of Enterprise single-family loans located in Duty to Serve Manufactured Housing, Rural, and High-needs Rural areas at the state and county levels.

2024 DTS Multifamily Dashboard

The Multifamily Dashboard is an interactive map that looks at the number of multifamily units supported by Enterprise loans that meet DTS income requirements for multifamily objectives in the Affordable Housing Preservation, Manufactured Housing, and Rural Housing markets.

We Want to Hear From You

Use the drop-down menus to submit comments on specific Duty to Serve requests for public comments, or to provide general input on the Duty to Serve program. You can also view previously submitted comments.

Explore Duty to Serve

Want to learn more about how the DTS program works? Learn about the underserved markets, process timeline, plan structure, statutory and regulatory activities, evaluation process, and more.

Archive

There are many resources to help you better understand the Duty to Serve program, annual processes, markets, and plans.

Contact the Duty to Serve Team

Questions on Duty to Serve? Email us and we'll get back to you soon.

Page Last Updated: 1/30/26