Several studies document racial and ethnic disparities in underappraisal. Racial disparities in appraisers’ use of time adjustments for local house price growth are one important factor driving these results.

Introduction

Mortgage lenders typically have safeguards against appraisals above market value, which pose additional risk to financial institutions that fund mortgages. However, less attention is paid to mortgage appraisals below contract price, which will be referred to as underappraisals. These underappraisals can disrupt a home sale by requiring the buyer to either renegotiate the purchase price, put more cash down, or abandon the purchase. Recently, concerns have arisen over possible inaccuracies and inequities in mortgage appraisals, with striking press reports of low appraised values for Black homeowners replaced with much higher ones after a re-appraisal conducted with a white stand-in.1 Several recent studies have found racial and ethnic disparities in underappraisal rates.2 This blog examines time adjustments for recent house price growth, one mechanism that can drive these disparities.

Time Adjustment and Underappraisal

Rapid house price growth typically leads to more underappraisal, according to appraisal experts,3 economic theorists,4 and statistical studies.5 Because past sales of comparable properties underlie appraised values, they will be too low when prices are rising rapidly. In principle, an appraiser can adjust for price changes that have occurred since a comparable property sale, a process known as time adjustment.6 For example, when appraisers determine that local house prices have grown 5 percent since the sale date of a comparable property, they can increase the subject property’s appraisal value by the same amount. However, in practice, appraisers do not time adjust very often, even when adjustment could substantially improve the appraisal. To learn more, see the companion Federal Housing Finance Agency Insights Blog, “Underutilization of Appraisal Time Adjustments”.

While lack of a time adjustment does not cause harm on its own, it can complicate home purchases when it leads to underappraisal. The connection between underappraisal and price growth, and the role of time adjustments in accounting for that price growth, raises the question: “Is the racial disparity in underappraisal, or some portion of it, due to racial disparities in the practice of time adjustment?”

This question is examined here using appraisal data for single-family housing from the Uniform Appraisal Dataset (UAD) collected by Fannie Mae and Freddie Mac. The UAD includes all appraisals submitted to Fannie Mae and Freddie Mac, which amounts to millions of appraisals per year. For purposes of this analysis, a 5 percent sample of the UAD data is used. The time period covered, the third quarter of 2018 through the fourth quarter of 2021, includes all the UAD data available to FHFA when the analysis began.7

Time Adjustments for Appraisals Initially Below Contract Price

While Fannie Mae, Freddie Mac, and Federal Housing Administration appraisal guidelines require time adjustments whenever market conditions have been changing, they seem to be frequently omitted when properties can still appraise above the contract price in their absence. The importance of time adjustments is apparent when considering the appraised value without time adjustment, meaning before that step of the appraisal process. When a property appraises above contract before time adjustments, appraisers adjust only 5 percent of the time, but do so 64 percent of the time when a property initially appraises below contract.8 This pattern suggests that appraisers consider time adjustments only as one of their final steps after substantially completing an appraisal.

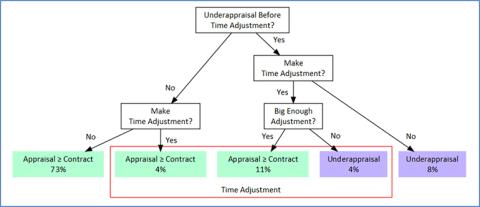

Figure 1 shows a cross-tabulation of the UAD data, arranged in a classification tree, which illustrates the assumption that time adjustments occur at the end of the appraisal process. In the left branch, 77 percent of properties appraise above contract without time adjustments, and appraisers make time adjustments for only four of 77 (5%) such properties. In the right branch, 23 percent of properties appraise below contract without time adjustments. For these properties, time adjustments can impact whether an appraisal is below contract, so appraisers unsurprisingly adjust much more frequently. In such situations, appraisers make time adjustments for 15 of 23 (64%) properties.

Figure 1: Time Adjustment and Underappraisal with Hypothetical Appraisal Workflow

Source: FHFA analysis of 3Q18 to 4Q21 UAD data (5% sample).

Figure 1 suggests that time adjustments are an important determinant of underappraisal. Appraisers make time adjustments for only 19 percent of properties, outlined in red in the figure, but these adjustments are often the decisive factor in determining underappraisal (11 of 19 properties, as represented in the center green box). The non-decisive 8 of 19 properties are split evenly between appraisals for which the value is above contract even without the adjustment (4 percent in the green box), and those where adjustments are not large enough to increase the appraisal above the contract price (4 percent in the purple box). Another way to appreciate the importance of time adjustments is to note that 23 percent of properties are underappraised before time adjustments (three right-most boxes), but only 12 percent afterwards (two purple boxes).

Disparities in Time Adjustment and Underappraisal

During the period examined here, appraisers time adjusted at least one comparable property for only 18.5 percent of all properties being purchased, despite national house prices growing robustly during the entire period and very rapidly during 2021. Time adjustments are least common for homes in majority-Black tracts at only 13.4 percent, as opposed to 18.4 percent in majority-white tracts. In majority-Hispanic tracts and “no majority” tracts, there is no statistically significant difference from majority-white tracts. Hereafter, majority-Black tracts are referred to as Black tracts, majority-Hispanic tracts as Hispanic tracts, and so forth.9

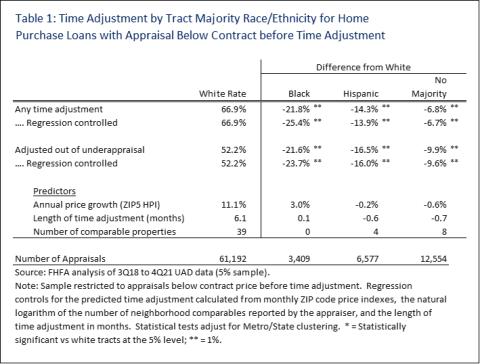

When we focus on appraisals below the contract price before time adjustments, larger disparities emerge. Table 1 shows that, among these appraisals, appraisers ultimately time adjust at a 67 percent rate in white tracts, but only at a 45 percent rate in Black tracts, a disparity of 22 percentage points. We see disparities of 14 and 7 percentage points when comparing Hispanic and no-majority tracts, respectively, to white tracts.

These simple comparisons of means understate the disparity because average annual house price growth, an important predictor of time adjustments, is 3 percentage points higher in Black tracts during this period (14%) as opposed to white tracts (11%). Two other important predictors, the length of time adjustment and the number of comparable properties available, are about the same. Regression analysis confirms that the disparities cannot be explained by these market conditions.10 After regression adjustment, disparities increase in Black tracts to 25 percentage points, while remaining about the same in Hispanic and no-majority tracts. Thus, for potentially decisive time adjustments, disparities are considerably larger than in the full sample and affect homebuyers in Black, Hispanic, and no-majority tracts.

Further, examination of decisive time adjustments also shows large disparities. In white tracts, 52 percent of appraisals initially below the contract price rise above the contract price through time adjustment. However, this happens only 30 percent of the time in Black tracts, a disparity of 22 percentage points. The disparities are 17 and 10 percentage points, respectively, in Hispanic and no-majority tracts, compared to white tracts. Adding regression controls leads to little change in these figures.

Time adjustments can make the greatest difference for borrowers with appraisals initially below contract who are similar to the marginal borrowers that represent the focus of bank regulator compliance reviews and economic theory.11,12 As marginal borrowers teeter between approval and denial, additional help can be decisive. The precarious situation for these borrowers is sometimes referenced in the “thick folder” theory of discrimination, where loan officers can choose whether to make an extra effort to assist the borrower in submitting additional documents to explain or compensate for any blemishes in their application.13

Conclusion

Time adjustments closely relate to underappraisals. Appraisers rarely make time adjustments for appraisals that are already above contract without adjustment, but frequently make them for those below contract. The adjustments are often decisive in determining whether a home appraises below contract, with 23 percent having underappraisals before time adjustment, and 12 percent afterwards.

Time adjustments are about 5 percentage points, or 37 percent, more common in white tracts than in Black tracts. Focusing on appraisals for which time adjustments have the largest potential impact on homebuyers, those below contract price before the adjustments, larger and more widespread disparities emerge. After adjusting for key market factors, appraisals in white tracts are more likely to be increased above the contract price by time adjustments than those in Black and Hispanic tracts, by 24 and 16 percentage points, respectively, a difference of 83 percent and 44 percent in relative terms. For these borrowers, time adjustments could make the difference between an appraisal that allows a home purchase to move forward and one that does not.

1 For example, “Black Homeowners Face Discrimination in Appraisals,” New York Times, Published Aug. 25, 2020. Updated Jan. 26, 2023.https://www.nytimes.com/2020/08/25/realestate/blacks-minorities-appraisals-discrimination.html

2 Narragon et al. (2022) report appraisal disparities for home purchase loans in majority-Black and Latino tracts while Ambrose et al. (2022) finds disparities for Black and Hispanic borrowers seeking refinance loans, but not home purchase loans. For interested readers, citations are below.

Narragon, Melissa, Danny Wiley, Vivian Li, Zhiqiang Bi, Kangli Li, and Xue W, “Racial and Ethnic Valuation Gaps in Home Purchase Appraisals – A Modeling Approach,” Freddie Mac Economic & Housing Research Note (2022). https://www.freddiemac.com/research/insight/20220510-racial-ethnic-valuation-gaps-home-purchase-appraisals-modeling-approach

Ambrose, Brent W., James Conklin, N. Edward Coulson, Moussa Diop, and Luis A. Lopez. “Do Appraiser and Borrower Race Affect Valuation?” Available at SSRN 3951587 (2021).

3 Reuter, Scott, “Appraisals in Rapidly Changing Markets,” Freddie Mac Insight Articles, July 22, 2021. https://sf.freddiemac.com/articles/insights/appraisals-in-rapidly-changing-markets

4 Quan, Daniel C., and John M. Quigley. “Price formation and the appraisal function in real estate markets.” The Journal of Real Estate Finance and Economics 4 (1991): 127-146.

5 Fout, Hamilton and Vincent Yao, “Housing market effects of appraising below contract,” Fannie Mae White Paper, available at: https://www.fanniemae.com/sites/g/files/koqyhd191/files/migrated-files/resources/file/research/datanotes/pdf/fannie-mae-white-paper-060716.pdf

6 More formally, these are called data of sale and time adjustments, or market conditions adjustments.

7 For a description of the data, see the companion piece, Underutilization of Appraisal Time Adjustments and the Fannie Mae UAD site (https://singlefamily.fanniemae.com/delivering/uniform-mortgage-data-program/uniform-appraisal-dataset). The data used here differs from the companion piece because it is at the subject property level rather than the comparable property level. In addition, the dataset includes only properties with home purchase loans, while excluding newly constructed properties because they tend to show little or no underappraisal disparities. Time adjustment rates are the percentage of subject properties for which at least one comparable property had a time adjustment.

8 The time adjustment is averaged across the comparables, including those with a time adjustment of zero.

9 “No-majority” tracts are those without a white, Black, or Hispanic majority. A substantial share of the Asian population (45%) lives in these tracts. At the same time, the plurality of people in the no-majority tracts are white, with Asians constituting the fourth-largest group, Hispanics the second, and Blacks the third. This analysis does not include a majority-Asian category because only a small share of the Asian population (11%) lives in majority-Asian tracts.

10 The regression controls for the predicted price adjustment, which is a more precise measure of the need for time adjustments than the annual price growth reported in the table, because it considers the time since the comparable properties sold.

11 Office of Comptroller of the Currency, Comptroller’s Handbook : Consumer Compliance : Fair Lending, Version 1.0 (2023). https://www.occ.gov/publications-and-resources/publications/comptrollers-handbook/files/fair-lending/index-fair-lending.html

12 Cosans, Christopher E. “Should Fair-lending Investigators Better Mix Qualitative and Quantitative Methods?” Journal of Financial Regulation 5.1 (2019): 91-100.

13 Ladd, Helen F. “Evidence on discrimination in mortgage lending.” Journal of Economic Perspectives 12.2 (1998): 41-62.

Tagged: FHFA Insights Blog; Appraisals; Underappraisal; Market Conditions Adjustment; Fair Lending; Race and Ethnicity; Uniform Appraisal Dataset (UAD)

By: Scott Susin

Senior Economist

Office of Fair Lending Oversight

Division of Housing Mission and Goals