Climate Scenario Analysis is a tool for assessing exposure to climate-related risks under different future climate conditions. Preliminary analysis highlights the importance of resolving data and methodology gaps to enhance confidence in the results. It also reveals the sensitivity of results to modeling assumptions.

Background

The safety and soundness of the U.S. housing finance system could be adversely affected by the risks associated with climate change, which can disrupt the financial system.1 These risks pose significant costs on the housing finance system and could increase delinquencies, defaults, and foreclosures, especially if borrowers are underinformed or underinsured.2 Additionally, climate-related risks could cause long-term harm to local economies, infrastructure, and housing prices that could lead to decreases in habitability and affordability. As such, it is critical for the Federal Housing Finance Agency (FHFA) to better understand how climate risk will affect its regulated entities (Fannie Mae, Freddie Mac, and the Federal Home Loan Banks) as part of its supervisory responsibility to ensure they fulfill their mission and operate in a safe and sound manner, while providing liquidity for housing finance and community investment.

Climate-related risks may be evaluated through two primary categories. The first is physical risk, represented by damage to property, infrastructure, and land due to severe weather events and lasting environmental changes. The second is transition risk posed by policy and technological changes to achieve a greener, low carbon economy that may cause stress to households, certain institutions, or business sectors.

Climate-related physical risks such as hurricanes, wildfires, flood, and sea level rise can directly damage housing stock and reduce property values. Further, borrowers with expenses incurred from weather events may have less disposable income in the event of a disruption to income or employment. Similarly, reduced coverage from insurance companies in high-risk areas could negatively impact local economies and infrastructure, thereby placing downward pressure on house values. These risks may be transmitted to FHFA’s regulated entities through an increased probability of mortgage default and higher loss severity, resulting in higher expected losses.

The transition to a low carbon economy will also spur a significant reshaping of existing policies, means of production, and technologies across regions and sectors. In the long-run, potential transition policies—such as requirements for increased energy efficiency features in homes—could yield consumers increased savings from reduced energy usage and energy bills, while lowering overall macroeconomic costs by helping mitigate the physical impacts of climate change. In the short to medium terms, however, transition policies may also introduce stress to certain sectors or regions.

To this end, assessing the climate risk exposure of FHFA’s regulated entities is a key part of the Agency’s climate-related objectives.3 While FHFA and its regulated entities are broadly assessing exposure to different climate-related impacts, this blog focuses on climate-related flood risk.4 While the work is in its early stages, there are several important lessons for evaluating how climate risk may impact the housing finance market.5

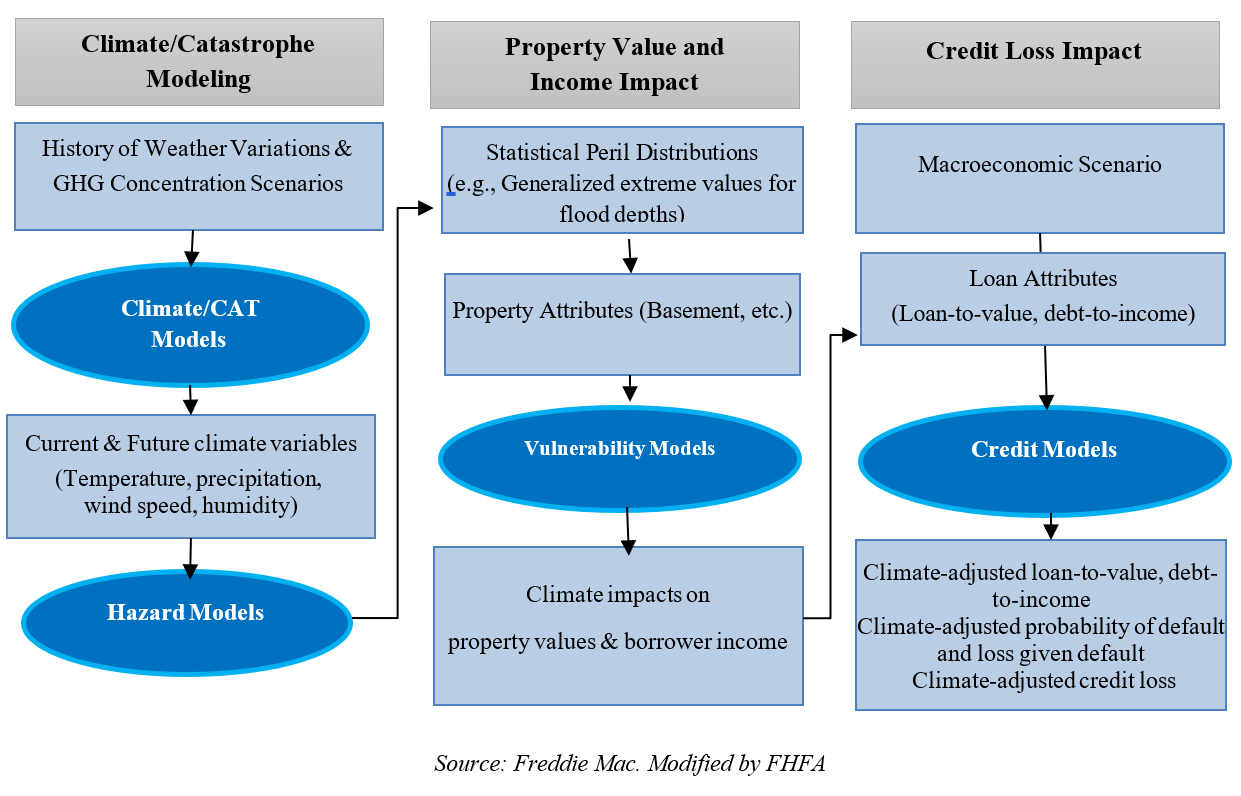

Climate Scenario Analysis

One tool used by financial institutions and regulators to assess exposure to climate-related risks is Climate Scenario Analysis (CSA).6 CSA relies on complex models—including natural hazard catastrophe models and integrated assessment models. While the former are used for physical risk analysis, the latter combine physical and social science models to forecast the impact of climate change on the economy under different climate scenarios.7 These forward-looking scenarios can include a range of forecasts to allow for a better understanding of the uncertainties around the impact of climate change and the potential stress on financial entities. CSA methodologies are relatively new but are evolving rapidly. Catastrophe and integrated assessment models typically only produce estimates for damages to property, and their output subsequently need to be incorporated into financial models to assess losses. The figure below provides an example framework for CSA as applied toward physical risks.

Lessons Learned

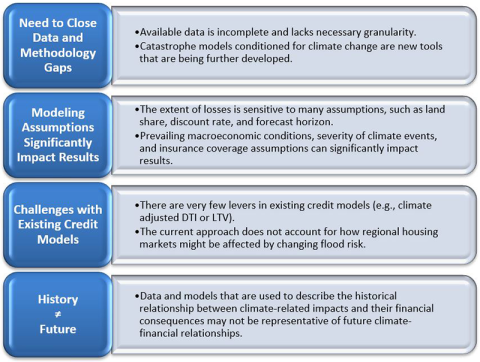

FHFA and its regulated entities performed exploratory CSA exercises to measure the regulated entities’ exposure to flood risk under a range of potential scenarios, methodologies, and assumptions. This provided FHFA with valuable insights into the regulated entities’ climate risk assessment capabilities, management practices, and challenges. The key observations are as follows:

First, performing CSA analysis of flood risk highlighted the importance of resolving data and methodology gaps to enhance confidence in the analysis, given the reliance of current tools on assumptions that introduce significant uncertainty. The available data are also incomplete and lack sufficient granularity for catastrophe models to accurately assess losses at the property level. For example, in the specific case of flooding, predicted losses from flooding can vary with the presence of a basement. These expected losses can also vary significantly depending on the underlying flood model. Further, catastrophe models were designed and traditionally used for estimating average losses in the near-term. Thus, their ability to accurately estimate tail risks and long-term losses is uncertain.

Second, the magnitude of losses is sensitive to modeling assumptions. For example, the impact of climate-related flood risk changes substantially based on the availability and coverage of flood insurance, the predicted severity of the flood events, and the prevailing macroeconomic conditions.

Third, existing credit loss models have limited capabilities to adjust for climate risks. One lever is to allow for a change in property value by flood-related damages or changes in insurance costs. This leads to a recalculation of the loan-to-value ratio, which is a key variable used to predict loan performance. However, this change does not account for the impact of changes in land value, exiting insurers, migration to other areas, and decreased economic opportunities due to frequent events.

Fourth, the data and models that are used to describe the financial impact of climate-related events may not be accurate in predicting future impacts.

These insights highlight that no single risk assessment can capture the full impact of increased flood risk or the other climate-related physical and transition risks. CSA can help FHFA and its regulated entities understand the resilience of the regulated entities to different climate outcomes over varying time frames.

Summary

FHFA and its regulated entities have made significant progress in developing their understanding of climate risks and CSA, as well as acquiring some of the necessary data and methodological tools to perform CSA. The regulated entities will continue to work on assessing their exposure to climate risks as the data and methodology mature. FHFA will also further develop expertise and capabilities related to climate scenario analyses and will evaluate other ways to assess exposure to these risks while providing guidance to the regulated entities. The work undertaken in these early years will serve as building blocks for future CSA exercises.

Responsibilities of the Climate Change and ESG Assessing Exposure to Climate Change Working Group:

- Develop expertise on climate-related risk analysis including the underlying data and methodology.

- Perform outreach to other stakeholders in this space.

- Build capacity for FHFA to run climate-related scenario analysis.

1 The Financial Stability Oversight Council (FSOC) discusses the threats of climate related risks to U.S. financial stability in their Report on Climate-Related Financial Risk, 2021, https://home.treasury.gov/system/files/261/FSOC-Climate-Report.pdf.

2 These concerns were expressed by many relevant stakeholders in response to FHFA’s Request for Input: Synopsis of Climate and Natural Disaster Risk Management RFI Responses (fhfa.gov).

3 See https://www.fhfa.gov/AboutUs/Reports/ReportDocuments/FHFA_StrategicPlan_2022-2026_Final.pdf and FHFA Annual Performance Plan for Fiscal Year 2024.

4 NOAA reports that tropical cyclones are the costliest billion-dollar disaster. (https://www.ncei.noaa.gov/access/monitoring/dyk/billions-calculations#:~:text=In%20short%2C%20tropical%20cyclones%20are,Price%20Index%20adjustment%20to%202024). The majority of these damages typically stem from flooding, and flooding is also expected to increase with climate change due to sea level rise and warmer atmospheres holding more water.

5 For information on how climate change might impact the housing finance sector beyond the scope of CSA, see FHFA’s Working Paper “When Climate Meets Real Estate” for an overview of the academic literature at the intersection of housing finance and climate change: https://www.fhfa.gov/PolicyProgramsResearch/Research/Pages/wp2305.aspx.

6 Central banks of the U.S., Europe and England have been pursuing climate scenario analysis. See, for example, participant instructions for the Federal Reserve Board: https://www.federalreserve.gov/publications/climate-scenario-analysis-exercise-instructions.htm.

7 The leading global resources on climate scenarios are the Network for Greening the Financial System (NGFS) on-line portal (see https://www.ngfs.net/ngfs-scenarios-portal/) and the Intergovernmental Panel on Climate Change (IPCC) (see https://www.ipcc.ch/).