This blog discusses Fannie Mae and Freddie Mac acquisitions of mortgages secured by real estate titled manufactured homes, with a particular focus on the period since the introduction of the Duty to Serve program in 2018. Manufactured housing is one of the identified Duty to Serve underserved markets and overlaps with other Duty to Serve components, such as supporting the underserved rural housing market.

Introduction

Manufactured homes (MH) are factory-built, prefabricated dwellings, constructed according to the Manufactured Home Construction and Safety Standards administered by the Department of Housing and Urban Development (HUD Code).[1] HUD Code compliant MH are exempt from local building codes. Local officials generally issue Certificates of Occupancy for new MH based only on inspections of MH’s foundations, anchoring, and utility connections.[2] In addition, factory production yields construction costs that are much lower than what is typical of site-built homes.[3] Although MH serves as an existing (and potential) source of affordable housing in many parts of the nation, its presence is strongest in rural and small-town communities where MH comprises 13 percent of occupied dwellings.[4]

The Housing and Economic Recovery Act of 2008 (HERA) established a duty for Fannie Mae and Freddie Mac (the Enterprises) to “increase liquidity and improve the availability of investment capital” for MH through the development of “loan products and flexible underwriting guidelines to facilitate a secondary market for mortgages on manufactured homes for very low-, low-, and moderate-income families.”[5]

The Federal Housing Finance Agency’s (FHFA) 2016 Enterprise Duty to Serve (DTS) Underserved Markets Regulation (DTS Regulation) addresses, among other things, Enterprise support for:

- Financing of MH titled as real property (MHRP) (i.e., loans secured by both the home and the underlying land);

- Financing of MH titled as personal property (MHPP) (i.e., loans secured only by the home, exclusive of the underlying land);

- Financing of MH communities (MHCs) owned by a non-profit organization, governmental entity, or the residents; and

- Financing of MHCs that provide, at a minimum. certain tenant pad lease protections.[6]

The DTS Regulation requires each Enterprise to adopt DTS Underserved Markets Plans (DTS Plans) that lay out target objectives and activities over a three-year term. FHFA reviews each proposed DTS Plan and, if satisfied, issues a non-objection (permission to proceed). FHFA also annually evaluates whether each Enterprise has accomplished its DTS Plan objectives and activities. The Enterprises adopted their first three-year DTS Plans in 2018 and are currently operating under Plans covering 2022-2024.[7]

Enterprise MHRP Loan Acquisitions

Since adopting their first DTS Plans in 2018, the Enterprises have focused on increasing their acquisitions of MHRP loans eligible for DTS credit. At present, the Enterprises only acquire MHRP loans and not MHPP loans.[8] Freddie Mac’s current DTS Plan contemplates the possibility of purchasing between 1,500 and 2,500 MHPP loans in 2024, as a means of “gather(ing) additional information needed to build a sustainable product…”[9]

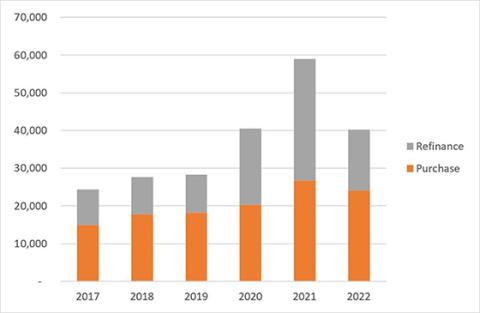

Total Enterprise MHRP loan acquisitions increased 141 percent between 2017 and 2021 (from 24,444 to 59,037) (Figure 1). Most of these acquisitions were rate-term refinances of MHRP loans, but Enterprise home-purchase MHRP loan acquisitions rose 79 percent over this period (from 14,900 to 26,700). The highest number of home-purchase MHRP loan acquisitions occurred in 2021. Of the 59,037 MHRP loans the Enterprises acquired in 2021,[10] 35,543 (60%) qualified for DTS credit based on borrower income.[11]

In 2022, rising interest rates significantly reduced rate-term refinancings and home-purchase loan originations across the entire mortgage market. As a result, Q4 2022 site-built home-purchase originations were 45 percent below Q4 2021 levels, according to one data provider.[12] In contrast, the Enterprises’ 2022 home-purchase MHRP loan acquisitions fell only 10 percent (Figure 1).

Figure 1. Manufactured Housing, Total Enterprise MHRP Loan Acquisitions, by year (2017-2022) and Loan Purpose

Source:FHFA

MHRP loans made to borrowers below median income generally qualify for the underwriting flexibilities offered through Fannie Mae’s HomeReady[13] and Freddie Mac’s Home Possible[14] programs, which include lower down payment requirements (3 vs. 5 percent) and adjustable (vs. fixed) interest rates.[15]

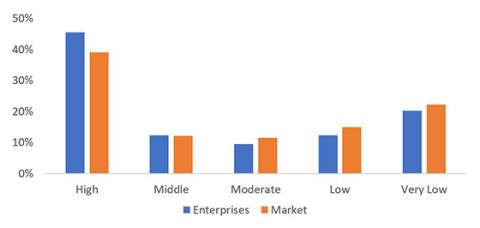

The distribution of Enterprise MHRP loan acquisitions by borrower income closely resembles that seen in the overall mortgage market, especially for home purchase loans (see Figure 2). Enterprise MHRP loan acquisitions have a somewhat larger share of high-income MH borrowers (above 125 percent of area median income, 45 percent vs 39 percent), and slightly smaller shares in all other income classifications.[16]

Figure 2. Manufactured Home Loan Borrower Income Distributions, Home Purchase Loans (2018 – 2021), Comparing the Enterprises to the Market

Source: Home Mortgage Disclosure Act (HMDA) reporting and FHFA. Income classes are relative to metropolitan area median incomes: Very Low (<= 50%), Low (51-80%), Moderate (81-100%), Middle (101-125%), and High (> 125%).

Support for the MH Industry CrossMod® Home Initiative

Zoning by-laws, subdivision ordinances, and other land-use regulations exclude MH homes from most single-family neighborhoods.[17] To better comply with single-family land use regulations, MH manufacturers introduced CrossMod® homes in 2019, a new class of MH that are affixed to permanent foundations and classified as real property, with comparable architectural, landscaping, site design, and energy efficiency features to site-built homes.[18] In recognition of these unique attributes, Fannie Mae developed its MH Advantage[19] program and Freddie Mac developed its CHOICEHome[20] program.

These programs offer CrossMod® borrowers underwriting flexibilities not otherwise available to other MH borrowers. For example, Fannie Mae’s Selling Guide states that appraisal report comparable sales for MH Advantage homes can include no more than one standard MH home. Other comparable sales must be CrossMod® or site-built homes.[21] Freddie Mac’s Selling Guide states that appraisal reports for CHOICEHome properties should contain at least one comparable CHOICEHome sale and, if no comparable CHOICEHome sales are available, the appraiser must use the most appropriate site-built homes as comparable sales.[22]

As CrossMod® homes tend to be at the higher end of the MH price range, incomes of many CrossMod® buyers exceed area medians. This means that CrossMod® MHRP loan acquisitions rarely qualify for DTS credit, but CrossMod® homes typically sell for all-in prices well below those of comparable site-built homes.[23]

Support for Single-Wide MHRP Loans

Borrowers with lower incomes tend to live in single-wide (single section) MH homes instead of larger, more expensive double-wide MH homes (two sections joined together).[24] Most single-wide properties titled as MHRP are financed by specialty lenders affiliated with MH manufacturers. MH specialty lenders dominate the single-wide MHRP loan market in part because single-wide MHRP loan sizes often fall below the minimum principal balance requirements of conventional mortgage lenders,[25] and some mortgage insurers will not insure single-wide MH.[26] Frequently, MH specialty lenders make higher cost MHPP loans to owners of single-wide properties titled as MHRP even though these borrowers would likely be better served by MHRP loans.[27] In 2021, the Enterprises began purchasing single-wide MHRP loans.[28] This initiative should expand the number of conventional mortgage lenders willing to originate single-wide MHRP loans.

Support for New MH Construction

The Enterprises support new MH construction through the purchase of “construction-to-permanent” loans that fund the cost of the new MH, the underlying land, and associated transportation and installation costs.[29]

Conclusion

MHRP loan acquisitions are a small but growing part of the Enterprises’ single-family business. The MHRP loans eligible for DTS credit are an important component of Enterprise support for very low-, low-, and moderate-income families.

1 Department of Housing and Urban Development Web Page, Manufactured Housing and Standards- Frequently Asked Questions, available at, .

2 See Fannie Mae Selling Guide § B5-2-01 et. sec., available at, www.fanniemae.com; and Freddie Mac Seller Servicer Guide §5703.1 et sec., available at, www.freddiemac.com.

3 12 U.S.C. § 4565

4 Housing Assistance Council tabulations of U.S. Census Construction of Housing, cited in Lance George, Manufactured Housing In Rural America, Housing Assistance Council Rural Research Brief (July 2020), available at, https://ruralhome.org/wp-content/uploads/2021/05/Manufactured_Housing_RRB.pdf., at 2.

5 12 U.S.C. § 4565.

6 81 Fed. Reg. 96242 (Dec. 29, 2016), codified at 12 CFR part 1282, Subpart C.

7 See Freddie Mac materials, available at, https://sf.freddiemac.com/working-with-us/affordable-lending/duty-to-serve/manufactured-housing. See Fannie Mae materials, available at, https://www.fanniemae.com/about-us/what-we-do/duty-to-serve/manufactured-housing.

8 See, for example, Fannie Mae MH underwriting requirements, available at, https://selling-guide.fanniemae.com/sel/b5-2-03/manufactured-housing-underwriting-requirements.

9 See, Activity 2 in, Freddie Mac Duty to Serve Underserved Markets Plan 2022-2024, https://www.fhfa.gov/FreddieMac2022-24DTSPlan-April2022.pdf.

10 Fannie Mae Web Page, Learn about our Business, available at, https://www.fanniemae.com/about-us/esg/learn-about-our-business; Freddie Mac 2021 Annual Housing Activities Report (March 16, 2022), available at, https://www.freddiemac.com/about/pdf/AHAR2021_Report.pdf, p. 4.

11 FHFA, 2021 DTS Enterprise Quarterly and Annual Reports, Report on Fannie Mae 2021 Manufactured Housing Loan Purchases and Freddie Mac 2021 Annual Loan Purchase Narrative Reporting Template, available at, https://www.fhfa.gov/reports/duty-to-serve/enterprise-quarterly-and-annual/2021.

12 See, https://www.attomdata.com/news/market-trends/mortgage-origination/attom-q4-2022-u-s-residential-property-mortgage-origination-report/.

13 Fannie Mae, Single Family, Originating and Underwriting, HomeReady Mortgage, available at, https://singlefamily.fanniemae.com/originating-underwriting.

14 Freddie Mac, Single Family, Origination & Underwriting, Home Possible, available at, https://sf.freddiemac.com/working-with-us/origination-underwriting/mortgage-products/home-possible.

15 See, for example, Fannie Mae Selling Guide § B5-6-01, HomeReady Mortgage Loan and Borrower Eligibility (04/06/2022), available at, https://selling-guide.fanniemae.com/.

16 Again, we show 2018-2021 combined because individual year distributions are very similar to one another. 2018 was the first year of activity under the DTS Regulation, and 2021 is the most recent year for which HMDA data is available on market lending activity.

17 See, generally, Casey J. Dawkins, C. Theodore Cobalt, Marilyn Cavell, Steve Hullibarger, David B. Hattis, and Howard Wiseman, Regulatory Barriers to Manufactured Housing Placement in Urban Communities, Prepared for U.S. Department of Housing and Urban Development, Office of Policy Development and Research (January 2011), available at, https://www.huduser.gov/portal/Publications/pdf/mfghsg_HUD_2011.pdf.

18 CrossMod is a registered trademark of the Manufactured Housing Institute, see, https://www.manufacturedhousing.org/new-class-of-homes/ . See also, Clayton Unveils Ten New CrossMod Floor Plans for Home Buyers, Cision PR Newswire, September 24, 2020, available at, https://www.prnewswire.com/news-releases/clayton-unveils-ten-new-crossmod-floor-plans-for-home-buyers-301137235.html .

19 Fannie Mae, Single Family, Originating and Underwriting, Manufactured Housing Financing, MH Advantage, available at, https://singlefamily.fanniemae.com/originating-underwriting/mortgage-products/expand-your-business-mh-advantage-eligible-homes.

20 Freddie Mac, Single Family, Origination & Underwriting, CHOICEHome Mortgage, available at, https://sf.freddiemac.com/working-with-us/origination-underwriting/mortgage-products/choicehome-mortgages.

21 See, Fannie Mae: MH Advantage Appraisal Requirements: Information for Appraisers and Lenders, available at, https://singlefamily.fanniemae.com/media/7706/display#:~:text=For%20MH%20Advantage%20properties%2C%20appraisers,of%20two%20site%2Dbuilt%20homes.

22 Freddie Mac, Single Family Seller/Servicer Guide § 5703.9 (i), available at, https://guide.freddiemac.com/app/guide/section/5703.9.

23 Harold D. Hunt, It's Real: Seguin Welcomes Texas’ First CrossMod Manufactured Housing Development, Texas Real Estate Research Center, Texas A & M University (June 4, 2021), available at, https://www.recenter.tamu.edu/articles/tierra-grande/It's-Real-2305 .

24 Clayton Homes Web Site, Single Section Manufactured Homes with Plenty of Room, (April 25, 2022), available at, https://www.claytonhomes.com/studio/7-spacious-16x80-clayton-single-wides/.

25 Lender minimums tend to be between $100,000 and $150,000. See, https://themortgagereports.com/44716/do-mortgage-lenders-have-minimum-mortgage-amounts , for a discussion of this subject.

26 For example, National Mortgage Insurance Underwriting Guide, § 2.2.14, available at, https://www.nationalmi.com/wp-content/uploads/2021/12/National-MI-TrueGuide-4.4-Effective-2021-06-01-Final.pdf . For MGIC, see Section 3.13.08 of their underwriting guide, available at, https://www.mgic.com/-/media/MGIC/PDFs/71-40600_uwguide.pdf .

27 See, Consumer Financial Protection Bureau, Manufactured Housing Finance: New Insights from the Home Mortgage Disclosure (May 2021), available at, https://files.consumerfinance.gov/f/documents/cfpb_manufactured-housing-finance-new-insights-hmda_report_2021-05.pdf.

28 See, for example, Fannie Mae Single Family Guide, Manufactured Housing Financing, available at, https://singlefamily.fanniemae.com/originating-underwriting/mortgage-products/manufactured-housing-financing#:~:text=From%20single%2Dwidth%20to%20similar,an%20offering%20for%20your%20borrowers.

29 See, for example, Fannie Mae Learning Center, FAQs: Construction to Permanent Financing, available at, https://singlefamily.fanniemae.com/learning-center/originating-and-underwriting/faqs-construction-permanent-financing.

Tagged: FHFA Stats Blog; Source: FHFA; Fannie Mae; Freddie Mac; manufactured housing

By: John P. Foley

Principal Policy Analyst, FHFA

Division of Research and Statistics

By: Charles Capone

Supervisory Economist, FHFA

Division of Research and Statistics